Ever looked at a bill and thought, Alright, how much will this cost? That's the whole point of a fiscal impact statement (FIS for short), it's the price tag attached to legislation. It explains how much whatever it is the bill wants to codify. How much our state government expects to spend, where the money's coming from, and whether it'll drain your wallet down the road.

It's like a financial report card.

Filing a bill isn't free. Staff gets paid just to push it through the system. If a bill starts moving, the price tag climbs. And once it becomes law? Forget it. Costs add up and can spiral indefinitely. Even so-called "small" administrative expenses or minor funding tweaks add up. Government spending doesn't sit still, it grows, shifts, and almost always expands.

Unfortunately, most people skip reviewing FIS because they look technical and contain numbers, but they're not as complicated as they seem.

That's the point of this article: to help you understand FIS and break it down in a way that actually makes sense. Oh, and to get you in the habit of reading them.

Why FIS Exist

Our South Carolina law requires a FIS for any bill that could affect state or local finances. The folks over at the Revenue and Fiscal Affairs Office, or RFA, are the ones who get stuck crunching the numbers. They sit down, figure out what this bill's trying to shove into law, slap a price tag on it, and then point at whichever piggy bank—state or local—is about to get cracked open to pay for it.

What's a FIS Actually Telling You?

Here's the rundown of what you'll find in a FIS:

How much will this bill cost the government? Some costs hit immediately, others build over time.

Where's the cash coming from? Are we raiding the state budget? Begging for some federal handouts? Cooking up new fees to nickel-and-dime folks? Or maybe just shuffling dollars from one program to another like a shell game?

Is the government getting bigger? If this bill adds more agencies, hires more people, or adds extra management layers, you can bet the long-term costs will climb.

Will taxpayers eventually pay more? The answer to this question is usually yes. But even if a bill doesn't raise taxes today, all that extra spending has a way of circling back.

Not every FIS is a crystal-clear roadmap. Some use vague phrases like "fiscal impact indeterminate" or "unknown financial impact," which is often a sign that they haven't got a clue what it's really going to cost or they're just not ready to admit it. That's a red flag.

Where Does the Money Actually Come From?

The money doesn't just appear out of thin air. It has to come from somewhere. Let's break it down.

Here Are Some Different Pots of Money Bills Can Pull From

General Fund – The state's main pot of money is funded by income, sales, and corporate taxes.

Federal Funds – Sometimes, bills rely on money from the federal government. But federal dollars aren't guaranteed forever, and when they disappear, the state has to make up the difference.

Surplus Funds – Leftover money from previous budgets. Since this isn't a steady funding source, using it for ongoing programs can create financial gaps in the future.

Other Funds – Includes fees, fines, and specific revenue streams (think gas taxes for roads or licensing fees for businesses).

Point is, it's not free. Someone's paying for it, whether it's you now, you later, or some poor sap who didn't see it coming.

Here's the cheat sheet. Keep an eye out for these tells:

Creates a new agency, board, or commission – More offices and more staff.

Adds more government employees – Hiring more people, which means salaries, pensions, benefits, and long-term obligations that don't go away.

Expands an existing program – Some bills don't create anything new but broaden who qualifies for a government service, increasing costs over time.

Requires new oversight or enforcement – More rules? That's more inspectors, auditors, or badge-wearing types to make sure everyone's playing nice. Somebody's gotta pay 'em.

Creates mandatory reporting, licensing, or tracking – If a bill requires new data collection or compliance measures, there's an ongoing cost to maintain those systems.

Uses federal funding as a starting point – Oh, look, free money from D.C.! But, if that money disappears, the state is left paying for it.

Relies on surplus funds for an ongoing expense – Surplus money is one-time revenue. If a bill depends on it, what happens when the extra cash is gone?

Funds programs based on demand rather than a fixed amount – This is wild. Some bills are passed without any cap on spending. There is no ceiling, no limit, no mechanism to restrain the cost. The fiscal impact statement says the program will be funded based on demand rather than a fixed amount. That means the more people who sign up, the more the government spends, automatically, without a hard stop

One of the easiest ways to catch long-term costs is to look for phrases like "costs will be determined by participation" or "subject to future appropriations." That's usually code for: We don't know exactly how much this will cost, but it'll be more than what's listed here.

Example: FIS for S. 62 (Education Scholarship Trust Fund Expansion)

Let's review the FIS for S.62, which expands the Education Scholarship Trust Fund (ESTF) program to help you learn how to read one.

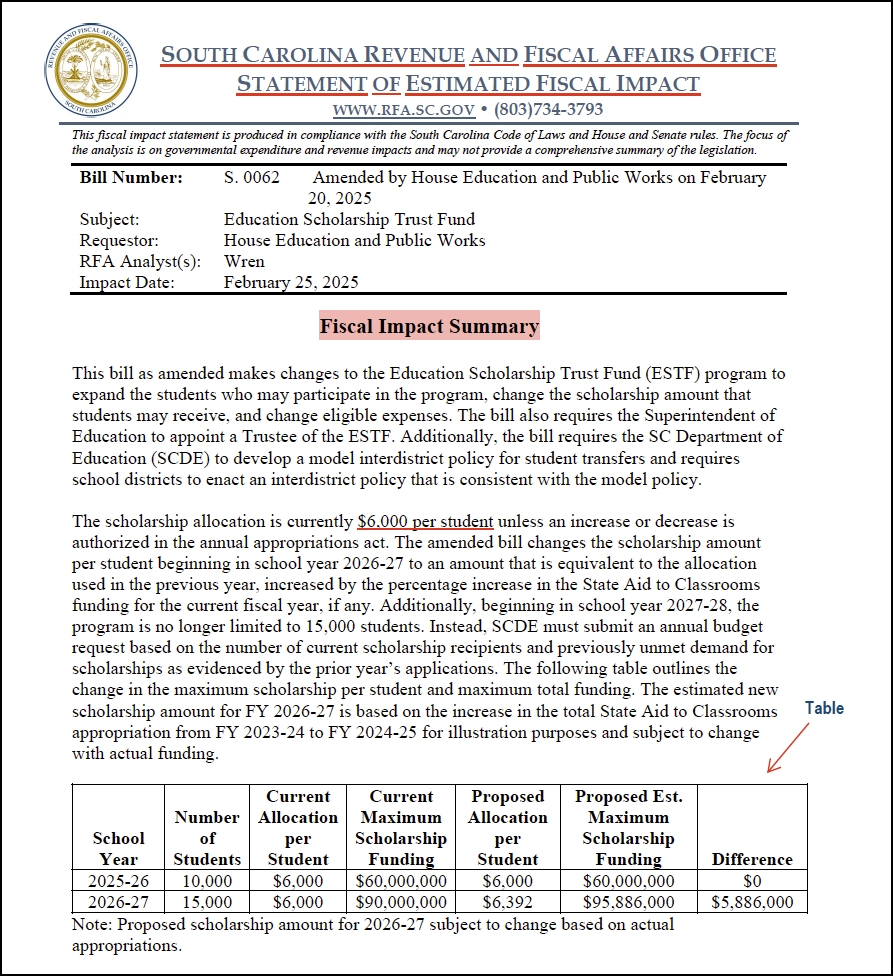

The "Fiscal Impact Summary" part overviews the bill's financial effects. This section often includes key figures, followed by a table that breaks down the numbers in a structured way. Tables are helpful because they clearly present financial details, making understanding estimated costs easier.

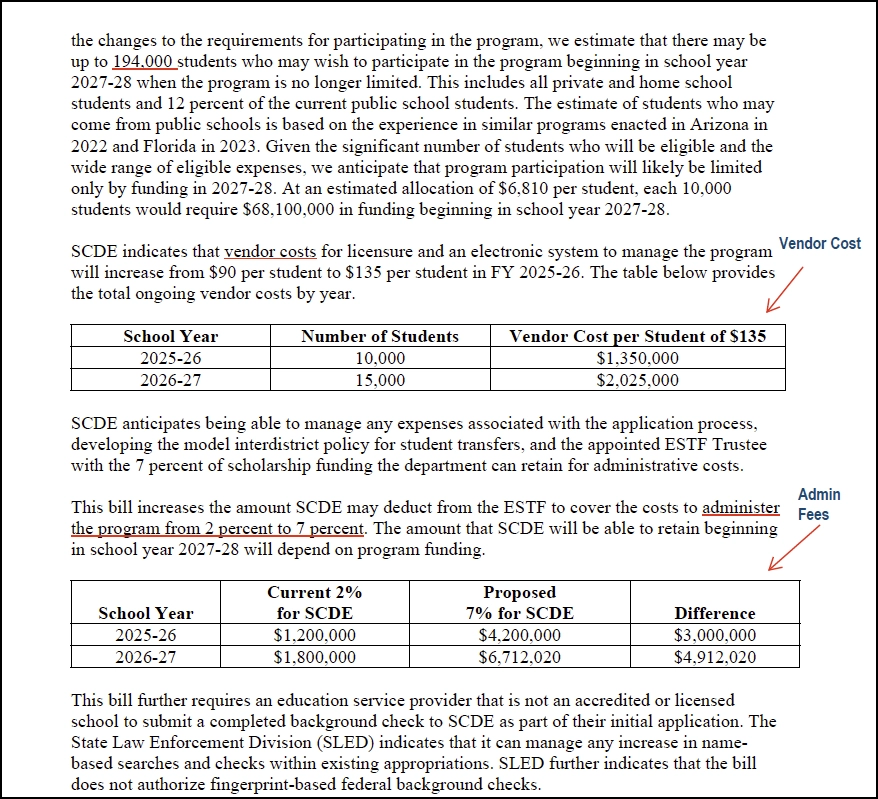

Next, you'll see other associated costs, such as vendor expenses and administrative costs, which go beyond the primary funding allocation.

Also, this FIS was amended, meaning cost estimates were updated as the bill changed.

Key Takeaways

Program costs increase from $60 million to $95.8 million by 2026-27

No spending cap after 2027-28, meaning total costs depend on participation levels

Per-student scholarship amount automatically increases each year based on State Aid to Classrooms funding formulas

Administrative costs rise from 2% to 7%, increasing the portion of funds allocated to program management

How to Interpret These Figures

Changes in total program cost – The table shows a steady increase in spending, with no upper limit beyond 2027-28.

Spending tied to participation – Because there is no cap on the number of students, costs increase as participation grows.

Automatic funding increases – The per-student allocation rises annually based on state funding formulas, meaning the total cost can fluctuate depending on budget changes.

Administrative cost adjustments – The Department of Education increases its share of funding from 2% to 7%, meaning more money is allocated to program management instead of scholarships.

Vendor costs increase from $90 per student to $135 per student, impacting program management expenses.

What does the S.62 FIS tell you? This bill is EXPENSIVE! Costs grow based on participation, state funding adjustments, and administrative changes. Without a limit on future spending, the program's total cost remains unpredictable.

Please note that the fiscal impact statement for Bill S.62 was based on a previous version of the bill. The final version has now passed into law, and the expense has increased. That change is not reflected in the current impact statement. That’s a serious problem.

Final Thought

Laws aren't free. Even the ones that seem minor have financial consequences, whether in direct spending, administrative costs, or long-term government expansion.

One of the best things you can do is read the FIS. It's a quick way to understand a bill's financial effects. So, check its FIS next time you hear about a new law. It'll show you if the bill expands government and increases spending.

Disclaimer: The views expressed in this article are those of the author and do not constitute legal or professional advice. ConservaTruth assumes no liability for any actions taken based on this content. Read more.

Subscribe to ConservaTruth's Email Newsletter for curated insights on South Carolina's legislative activities and conservative viewpoints, delivered straight to your inbox! With vetted and easy-to-understand information, our newsletter empowers you to become an informed and engaged citizen, actively participating in safeguarding our cherished Constitutional values. Don’t miss out on crucial updates—join our community of informed conservatives today.

Comments