So, here we go again, plan C.

On April 30, the House Ways & Means Committee gave the green light to the newly amended H.4216, the Income Tax Bill. Listen to the hearing in the archives if you’d like to hear it for yourself.

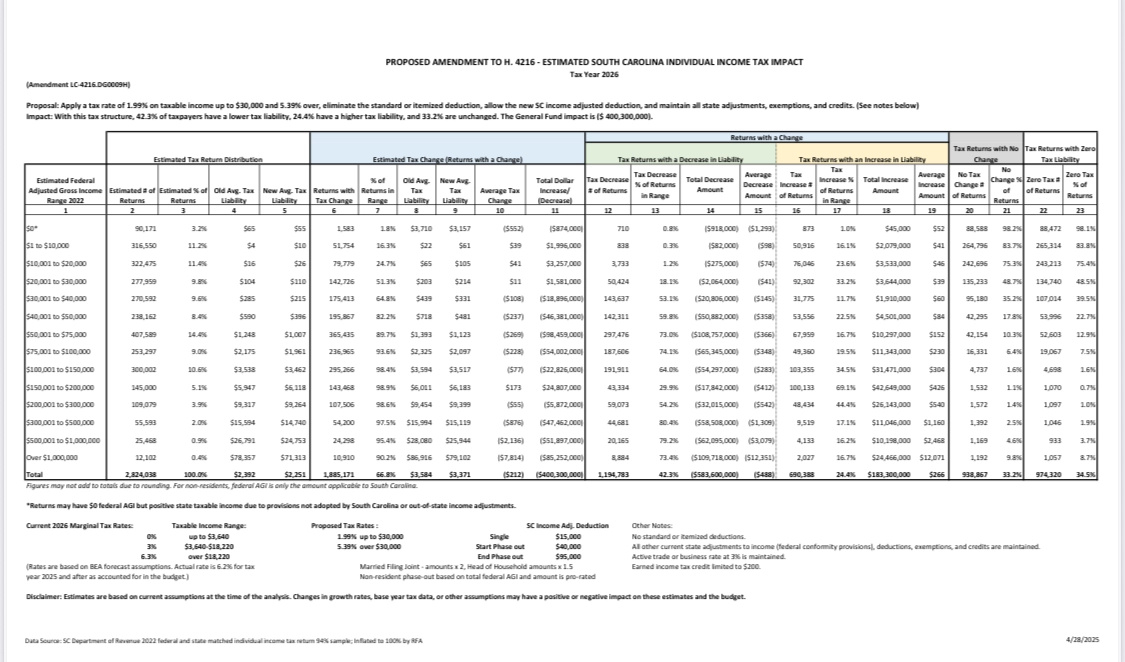

Here’s what changed. The latest version restructures the income tax system into two brackets → 1.99% on the first $30,000 of taxable income and 5.39% on everything after that. According to our generous House members, the goal is to eventually reduce the top rate to 1.99% and maybe even eliminate income tax entirely. Maybe. But that magic happens if state income tax revenue grows by 5% yearly.

In case it wasn’t obvious, the lower rate only applies to the first $30,000. The rest is still taxed higher.

But wait, who exactly is going to fund this “revenue” they keep mentioning? That would be us. The people. The workers. The families. The ones checking receipts at the grocery store and stretching every paycheck. Their “path to zero” only works if we keep generating more money for them to tax. So yes, they need you to earn more and spend more so they can collect more and maybe lower your rate someday. Maybe.

Now let’s talk numbers:

42.3% of filers will see a tax cut → Average decrease: $488

24.4% of filers will see a tax increase→ Average increase: $266

33.2% of filers will see no change at all → That’s more than 938,000 South Carolinians

New Deduction Amounts (SCIAD):

$15,000 for single filers

$30,000 for married filing jointly

$22,500 for head of household

Phase-out ranges:

Single: begins at $40,000, ends at $55,000

Head of Household: begins at $60,000, ends at $82,500

Married Filing Jointly: begins at $80,000, ends at $110,000

Also important:

State income tax still starts from federal AGI, not taxable income

The Earned Income Tax Credit is now capped at $200

State-specific deductions and credits still apply, if you qualify

So how did they shrink the tax hike numbers? By inflating government-dependent deductions.

(Source: SC Department of Revenue 2022 federal and state matched individual income tax return 94% sample; Inflated to 100% by RFA )

This is the compromise we’re supposed to clap for? One-third of South Carolinians get nothing. One-fourth get a higher tax bill. That means 57% of us are either paying more or exactly where we started. Meanwhile, we’re told to be patient, keep paying, and trust that someday it’ll come back around as a “cut.” That’s circular logic.

Meanwhile, senators gave themselves a raise. Yep. Lawmakers voted to nearly triple their in-district pay from $1,000 to $2,500. More money to create more government spending.

Let’s not forget that taxpayers also carry the weight of sales tax. It’s already high, and with local option taxes added in, it climbs even more. Yet with all the talk about income tax cuts, you’d think sales tax wasn’t part of the burden at all.

What about cutting government spending? That question never seems to make it into the room. Every version of this tax plan depends on the economy “growing” enough to fill the gap. Not one serious conversation about reducing the size or cost of state government. And if you’ve been following this year’s legislative session, it’s clear that spending isn’t going down anytime soon.

Another big issue that keeps getting shoved under the rug is this, why are so many South Carolinians still struggling to earn a livable income? The General Assembly says we have one of the strongest economies in the country. Jobs are booming. Businesses are moving in. But if that’s true, why do nearly half the state’s filers earn so little they owe nothing in income taxes?

Something doesn’t add up.

If things are so great, why can’t people afford to live? Why can’t they buy homes, raise families, or cover medical costs without government assistance? And with all the spending the state does year after year - billions - why doesn’t anything seem to improve?

Maybe it’s because the system was never built to improve life for hardworking South Carolinians. It was built to keep us all dependent on the government. And now, under this bill, we’re expected to keep feeding it, chasing the illusion that something will come back around. But that something is an illusion, too.

The truth is, this bill isn’t a win for the people. It’s the kind of compromise we’re expected to swallow until more people finally stand up and ask, why should we be the ones taking the hit? Why not cut government spending? Why not shrink the system instead of asking us to keep feeding it?

We are the revenue and we’re wide awake.

Disclaimer: The views expressed in this article are those of the author and do not constitute legal or professional advice. ConservaTruth assumes no liability for any actions taken based on this content. Read more.

Subscribe to ConservaTruth's Email Newsletter for curated insights on South Carolina's legislative activities and conservative viewpoints, delivered straight to your inbox! With vetted and easy-to-understand information, our newsletter empowers you to become an informed and engaged citizen, actively participating in safeguarding our cherished Constitutional values. Don’t miss out on crucial updates—join our community of informed conservatives today.

Comments