Friends, let's take a journey into the rollercoaster ride🎢 that is South Carolina's tax history. Picture this: a shrewd band of policymakers 😇 conceived a plan. It was simple - let the individual taxpayers bear the weight of a hefty tax rate that gyrates from 0.00% up to a staggering 6.50% 📈 while corporations settle into the cushy comfort of a flat 5.00% rate.

All in a day's work, right?

Then, in a plot twist no one saw coming 🙈, we were gifted 🎁 with the "Comprehensive Tax Cut Act of 2022". (Remember that win 🥴?) It came riding in on a promise to slash taxes 💸, armed with a catchy title to boot! However, it seems someone might have glossed over the meaning of 'comprehensive' while drafting this legislation 📜🤔.

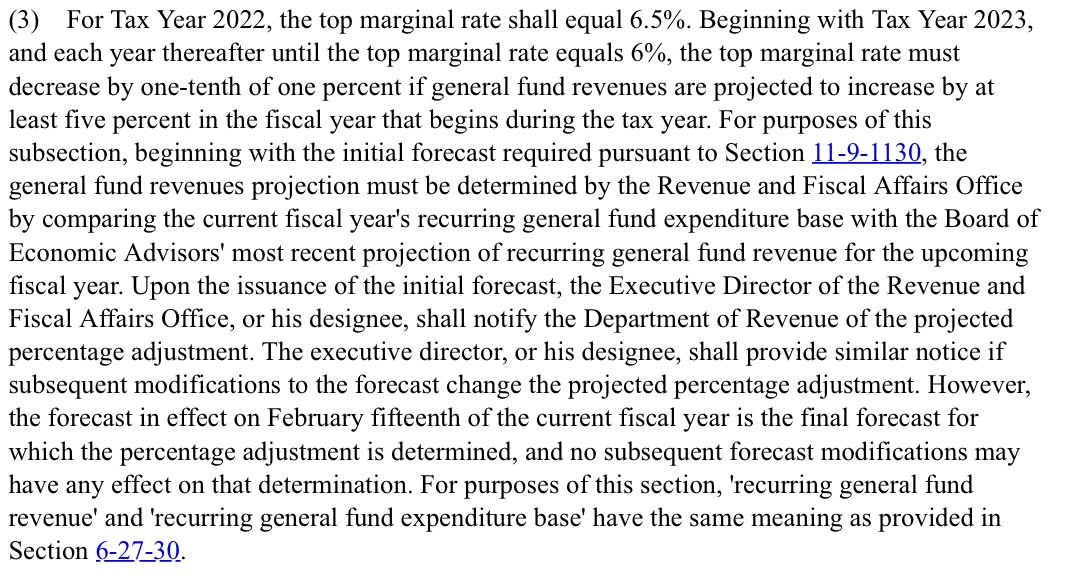

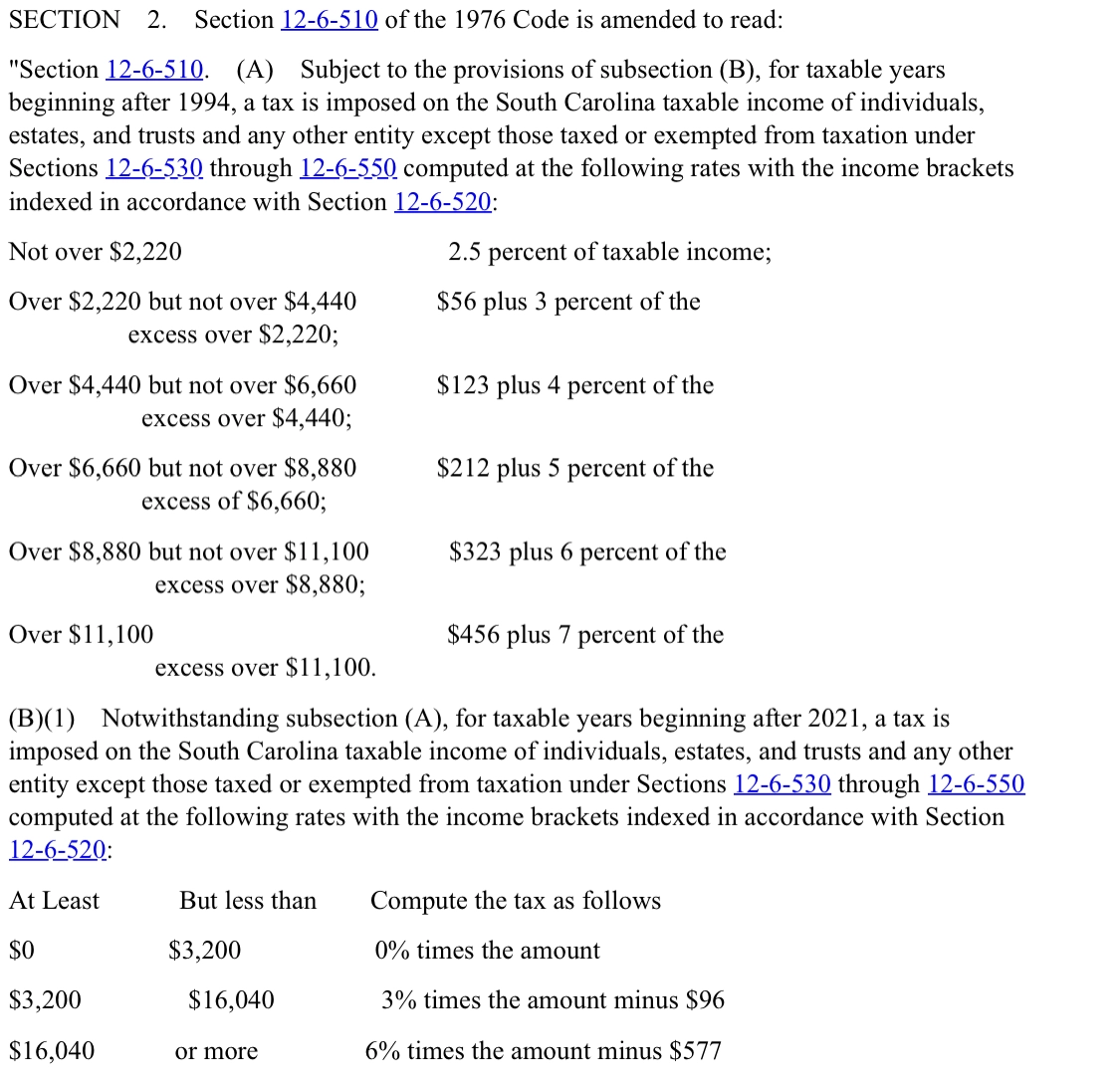

First up, the Act's blockbuster move 🎬 - chopping the highest marginal rate from 7 percent down to a less formidable, yet still noteworthy 6.5 percent. But the fun doesn't stop there. We're then treated to a slow-motion tax cut montage - a .1% annual decrease, all the way down to a breezy 6 percent. The catch 😎? This tax cut marathon only continues if the state's revenues grow by a minimum of 5% each year. Let's call it "economic roulette.”

$0 to $3,200: No tax is applied in this income bracket.

$3,200 to $16,040: The tax is calculated as 3% of the amount minus $96.

$16,040 and above: The tax is calculated as 6% of the amount minus $577.

The most typical salary in SC is $42K, so that means that most people will fall into that 6% tax bracket. Oh dear, there’s nothing quite like the thrill of realizing the majority of us have won the golden ticket to the 6% tax bracket 🎫 🥴.

Let’s continue with our journey.

Now let's bring our dear Governor McMaster into the spotlight💡 for his June 20, 2023, FY 2023-2024 State Budget announcement. He's been strutting his stuff on the fiscal runway, showing off South Carolina's surplus biceps and rainy-day reserve abs, not to mention the state's low-debt jeans. Sounds like a fiscal fitness model, right? But when you peek behind the curtain, you find out that taxpayers only get to keep a paltry $96.2 million out of the $1.4 billion recurring revenue surplus. Something just doesn't add up here 🤔.

Now don't get me wrong, the Act is certainly a start 🏁. But if this were a 1000-mile journey, we've just tied our shoelaces. This glacial pace of tax reduction leaves taxpayers hanging in the suspense 😳, turning tax cuts into an economic thriller. Will they get their much-needed tax relief, or will the ever-looming shadow of economic uncertainty snatch it away? It's like a game of fiscal Jenga - just a lot less fun.

And then there's that delightful little surprise - a 7.43 percent average sales tax. Just when South Carolinians thought they might see some relief from the tax monster, they're reminded that every trip to the mall 🛍️ is like a mini tax audit🕵️♂️.

Let's not forget our star performance on the 2023 State Business Tax Climate Index. As the old saying goes, "Reach for the stars ✨, even if you fall short, you'll land on the moon🌙 ". But in our case, we've missed both and have landed smack in the middle of mediocrity 😐, securing a rather unimpressive 31st spot.

All in all, while the 'Comprehensive' Tax Cut Act of 2022 makes a valiant attempt, it's a bit like an athlete who showed up to the race without his running shoes 👟💨. An immediate and significant tax cut would have been the winning ticket. But perhaps that's too radical - a tax cut that does what it's supposed to. Hopefully, in the next episode of South Carolina's tax melodrama, they'll get the script right ✍️🔜.

And there you have it, folks - the 'Comprehensive' Tax Cut Act of 2022, the sitcom of South Carolina's tax landscape, brought to you by our conservative policymakers, the stars of this red 🔴 state. You'd think they'd have figured out by now that their loyal audience would appreciate a little less comedy and a little more action when it comes to tax relief 😑. But as they say, the show must go on... and so, we wait for the next act.

Comments