Part 3

Welcome back to part 3 - A Comparison Between the Boiling of a Frog and the Proposed SC State Legislative Bill S-285, Summary: Providing Academic Choice in Education (PACE/ACE)

To whom it may concern,

VOTE NO TO BILL S-285!!!

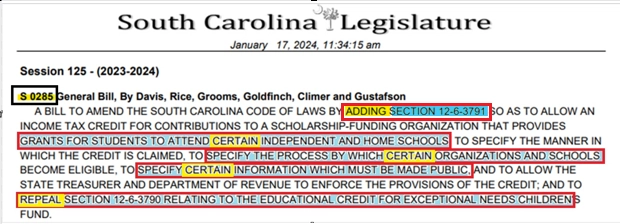

I am writing today asking you to vote NO to bill S-285, Summary: Providing Academic Choice in Education (PACE) bill. S-285 has also been referred to as the “ACE” bill and as an alternative to the other terrible “school choice” bill that has been identified as the Education Savings/Scholarships Accounts (ESA) that passed in a recent South Carolina legislative cycle.

Calling S-285 a “school choice” bill is misleading to the public, as only defined, and deemed “eligible students” may apply for the scholarship provided by the Educational Credit for Exceptional Needs Children’s Fund. It’s quite perplexing as to why S-285 (aka PACE/ACE) is being mislabeled as a school choice bill because it's an entitlement bill. Lobbyists, activists, legislators, and others who use the phrase “school choice” to reference S-285 are trying to pass it under false pretenses by misguiding the public with a slick wording selection.

The SC General Assembly is currently considering repealing and replacing SC Title 12 – Taxation, Chapter 6 – SC Income Tax Act- Section 12-6-3790. Bill S-285 currently lies in the Ways and Means Committee and may rewrite the tax code on what qualifies as an Educational Credit for the Exceptional Needs Children’s Fund and what is described as an “eligible school”, "eligible student”, “exceptional needs child”, and “qualifying expense”, amongst many other definitions.

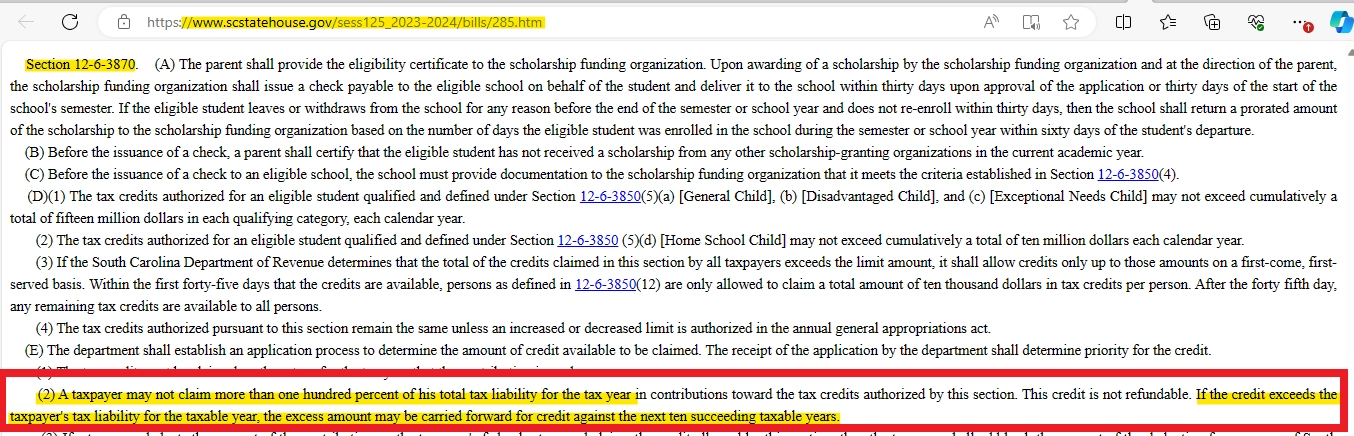

Bill S-285 is attempting to rewrite the tax codes for giving qualifying "eligible student(s)” access to funds for "certain" facilities under "certain" circumstances. This bill will create a new code that is attempting to increase the benefits (for a 3rd time since the fund’s inception) of a taxpayer that donates to the fund. Bill S-285 will give a 25% percentage tax liability claim increase to any donor of the fund. The current law allows a donor a 75% tax liability credit claim but will be replaced to allow up to “one hundred percent of his total tax liability for the tax year in contributions toward the tax credits authorized” for which “If the credit exceeds the taxpayer’s tax liability for the taxable year, the excess amount may be carried forward for credit against the next ten succeeding taxable years”. The law this bill wants to repeal currently allows the excess amount to be carried forward for credit against the next 3 succeeding taxable years. The proposed replacement law will increase this by 7 years. S-285 seems to be anticipating a large sum of money to instantaneously flow into the fund in a small time-period by allowing 10 years total time to utilize a donor’s tax liability credit claim. Such foresight this bill has.

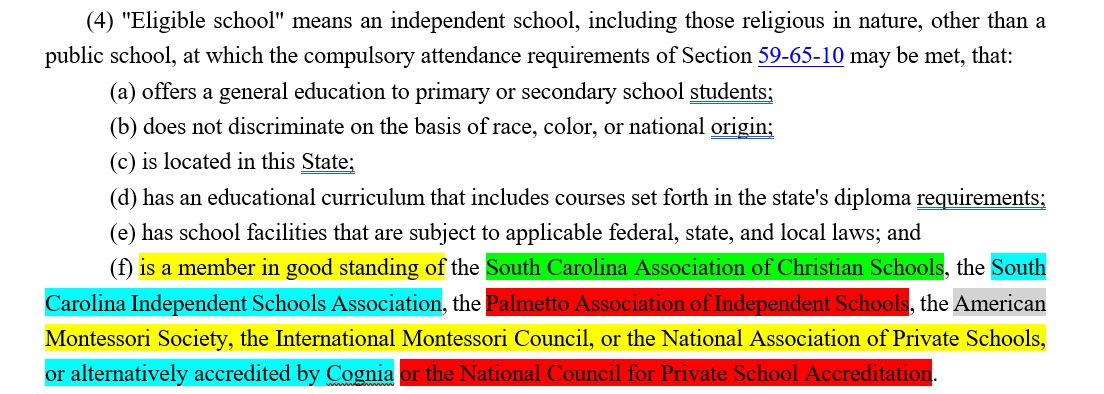

The initial law that birthed this income tax name changing fund organization, spans from a little more than a decade ago. Bill S-285 is also tied to accreditation “member in good standing" to a “certain” list of specific organizations to receive payment from the fund in the form of a grant scholarship, which is deemed permanent by the current law, to what is supposed to be a grant scholarship recipients’ school of choice.

The designation of a grant-scholarship to “certain” schools is by no means a “choice”. S-285 will permit any state “approved non-profit scholarship organization”, “to provide grants for tuition to children (deemed eligible) enrolled in an eligible school meeting the criteria of this section (determined by this bill) and grants for homeschool curriculum fees” that must be a “member in good standing” of any of the accreditation nonprofit and/or SC state incorporated organizations listed in the bill. S-285 (PACE/ACE), should it pass, will create a vacuum for a much bigger threat to providing more unsolicited pathways for dark money to flood the private/independent/religious educational school sector unchecked.

S-285 is NOT a true school choice option for parents to utilize. Instead, it is yet another bill attempting to repeal and replace current tax law on the already existing Educational Credit for Exceptional Needs Children’s Fund that provides grant scholarships to special needs children who reside in this state. S-285 is an entitlement bill as there will be a subset of school-aged students who are NOT deemed eligible to apply for a scholarship to attend a school program of “choice”, that exists outside of the publicly state funded school system/institution dictated by Title – 59, the state’s education laws. The bill also describes only a “certain” subset of schools will be eligible to cash in on the grant-scholarship money. The “eligible school” requirements as defined in the bill, state that an eligible school must be a “member in good standing" with specific accreditation organizations listed in the bill.

SC – Supposed school choice” bill S-285 Summary: Providing Academic Choice in Education (PACE/ACE):

is an income tax liability credit bill.

is a repeal and replace Title - 12 Taxation law that is specific to repealing a current section to the state's INCOME TAX laws.

wants to modify the currently approved Fund program that's been in State law since 2013. Since 2018, the original 2013 law has been transformed twice already. If this bill passes, it will be the law's 4th modification plan since the fund's inception.

is about funding a grant scholarship for a subset of the state's school-aged children.

defines a list of "certain" requirements for the usage of the created fund's "choice" of school.

Specifically defines the "choice" school must be a "member in good standing" with a “certain” list of accreditation associations/organizations/nonprofits.

ties the Fund to an entitlement grant "scholarship" payment (for tuition, tutoring and more!) only to be applied to "certain" criteria schools. The fund would release the scholarship money 💰 AFTER those requirements have been met.

There is no need for accreditation membership to be linked to the “choice" bill whatsoever.

Accreditation "membership" works like a trial-period. As you may already be aware of this, trial memberships have an expiration date, of which at the end of the trial period, you can NO longer continue to reap the benefits of the trialed club,

UNLESS... you join in on the purchase of their accreditation services (aka a school must pay to agree to receive the accreditors’ guidance and follow their rules).

Some of the accreditors listed on the bill are also written in SC law Title - 59.

Title - 59 is South Carolina’s state education laws for publicly funded schools.

South Carolina state regulation says it's OPTIONAL for private schools to be accredited.

Some of the accreditors on the bill say accreditation is "voluntary".

TO BE CONTINUED…

Part 1, Part 2 and Part 4

A Comparison Between the Boiling of a Frog and the Proposed SC State Legislative Bill S-285, Summary: Providing Academic Choice in Education (PACE/ACE)conservatruthblog.com Part 2 - A Comparison Between the Boiling of a Frog and the Proposed SC State Legislative Bill S285published Feb 15, 2024conservatruthblog.com

Part 2 - A Comparison Between the Boiling of a Frog and the Proposed SC State Legislative Bill S285published Feb 15, 2024conservatruthblog.com Part 4 - A Comparison Between the Boiling of a Frog and the Proposed SC State Legislative Bill S285Published March 13, 2024conservatruthblog.com

Part 4 - A Comparison Between the Boiling of a Frog and the Proposed SC State Legislative Bill S285Published March 13, 2024conservatruthblog.com

Sign Up!

Subscribe to ConservaTruth's Email Newsletter for curated insights on South Carolina's legislative activities and conservative viewpoints, delivered straight to your inbox! With vetted and easy-to-understand information, our newsletter empowers you to become an informed and engaged citizen, actively participating in safeguarding our cherished Constitutional values. Don’t miss out on crucial updates—join our community of informed conservatives today!

Comments